Tax Free Massachusetts 2025. On that day, new hampshire will join seven. The house finalized its $58.07 billion fiscal year (fy) 2025 budget last week after adding $95.8 million in spending over the course of three days of debate.

The budget begins as a bill that the governor submits in january (or february if at the start of a new term) to the house of. Enter your details to estimate your salary after tax.

The budget begins as a bill that the governor submits in january (or february if at the start of a new term) to the house of.

Use our income tax calculator to find out what your take home pay will be in massachusetts for the tax year.

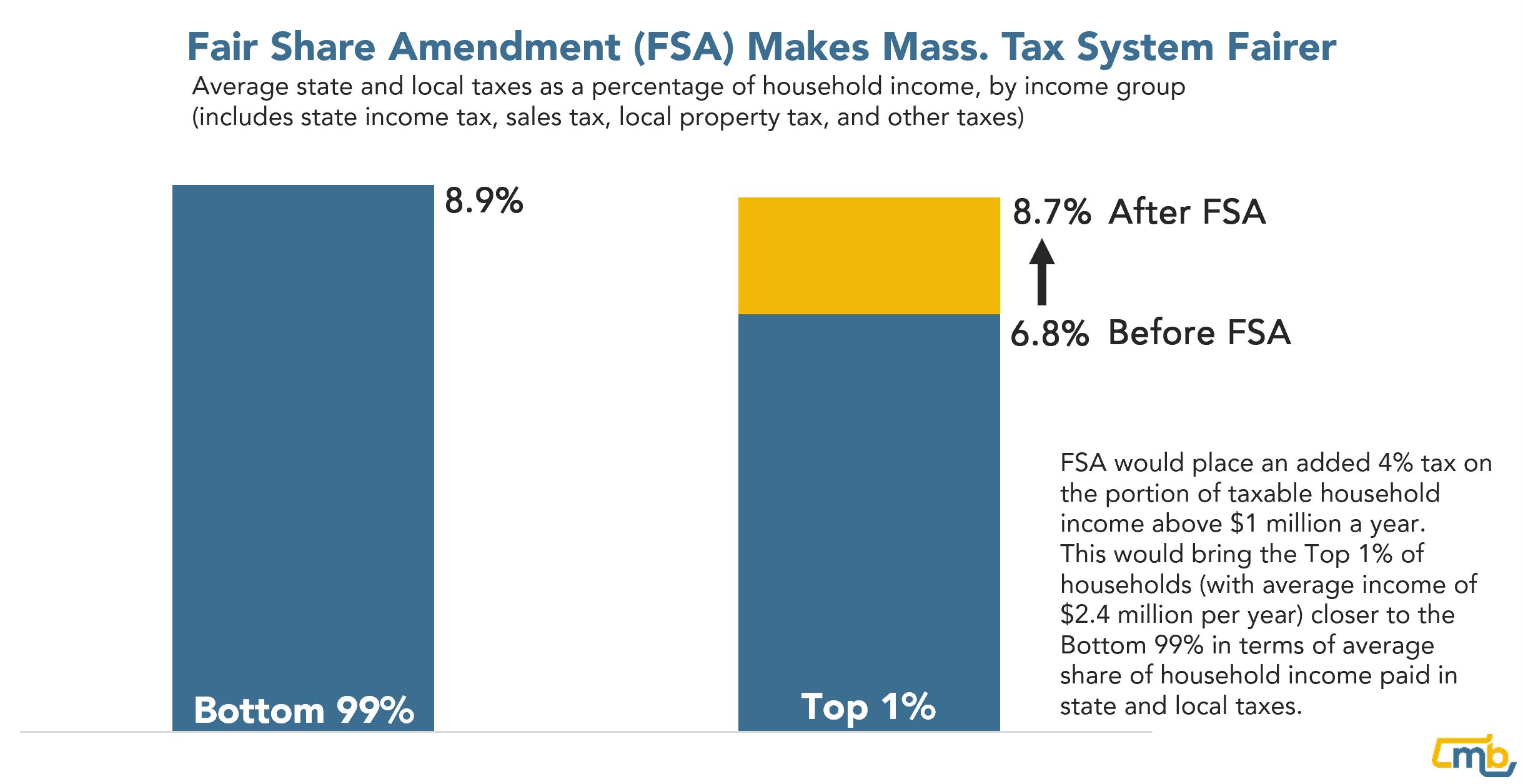

“Millionaire Tax” Would Make Massachusetts Tax System Fairer Mass, The state department of revenue estimated late last week that the fair share amendment, which requires people with incomes over $1 million, to pay a 4% annual. What is the 4% surtax?

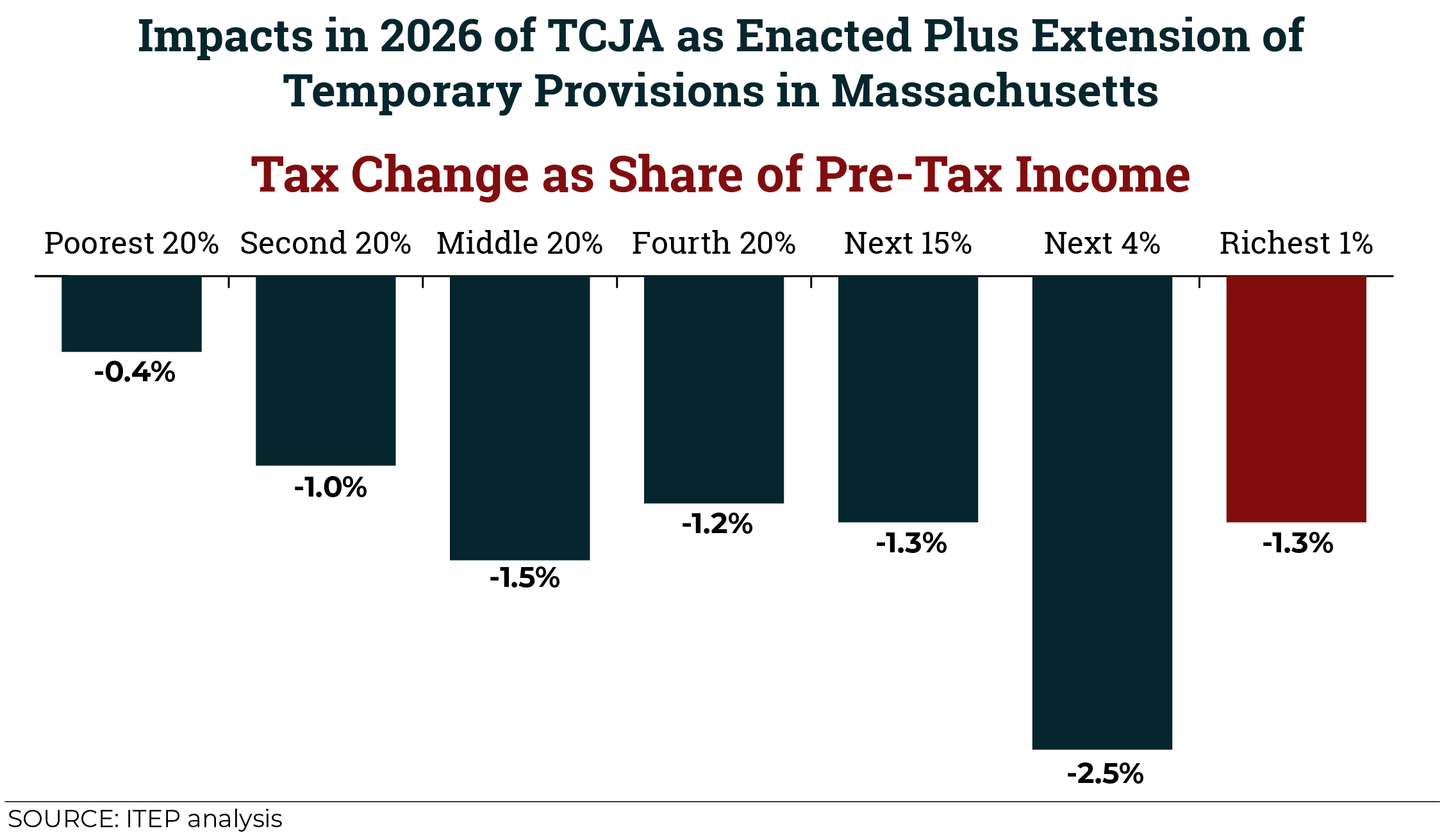

Tax Cuts 2.0 Massachusetts ITEP, Enter your details to estimate your salary after tax. 2025 estimated tax payment vouchers, instructions & worksheets.

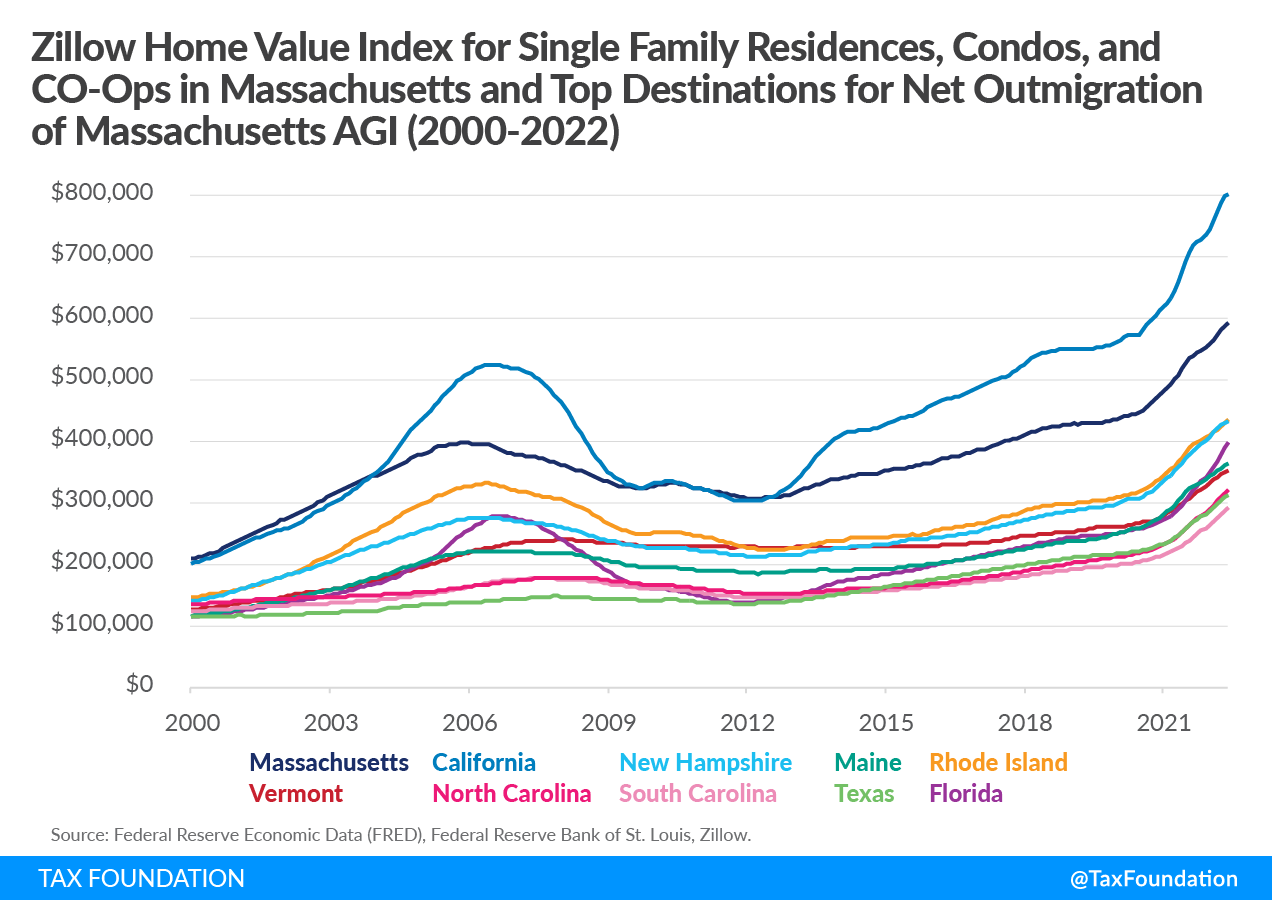

How the House Tax Proposal Would Affect Massachusetts Residents, The fair share amendment, which won with 52 percent of the vote, is part of a growing interest in some blue states to pass new taxes on the wealthy — a counter to. If you make $70,000 a year living in new hampshire you will be taxed $7,660.

Massachusetts Estate Tax Rates Table Estate Tax Current Law 2026, Use our income tax calculator to find out what your take home pay will be in massachusetts for the tax year. The fiscal impact of all amendments is.

T200018 Baseline Distribution of and Federal Taxes, All Tax, The state department of revenue now estimates the new surtax on top incomes will bring in between $1.6 billion and $2.1 billion for fiscal year 2025, and between $1.8 billion and. Canada’s national junior team head coach.

Massachusetts Millionaires Tax Massachusetts Graduated Tax, Starting with tax year 2025, personal income taxpayers must pay an additional 4% (4% surtax) on taxable income over $1,000,000,. House members filed 1,495 amendments, 71 fewer than in fy 2025 and 27 fewer than in fy 2025.2.

The Tax Cuts & Jobs Act Is Scheduled To Sunset In 2025 Do You Have A, Instead of sending a paper check with a payment voucher, individuals and businesses can make. The house finalized its $58.07 billion fiscal year (fy) 2025 budget last week after adding $95.8 million in spending over the course of three days of debate.

Massachusetts Corporate Excise Tax Should Be More Competitive, The fiscal year 2025 budget recommendation makes continued progress and substantial investments across state government to address mental health, substance use. Top lawmakers say it’s not a big deal,.

Massachusetts Millionaires Tax Massachusetts Graduated Tax, Use our income tax calculator to find out what your take home pay will be in massachusetts for the tax year. July 1 marks the start of the 2025 fiscal year, and once again, the massachusetts state budget is once again late.

massachusetts estate tax rates table Boisterous EJournal Stills Gallery, The state department of revenue now estimates the new surtax on top incomes will bring in between $1.6 billion and $2.1 billion for fiscal year 2025, and between $1.8 billion and. The fiscal impact of all amendments is.

Today the house ways and means (hwm) committee released its proposed budget to invest in our commonwealth for the fiscal year (fy) 2025, which starts in.